We have provided the secret to getting K20,000 instant loan from Biu money loans Zambia. As a civil servant, when unexpected expenses knock at your door like a thief from Lusaka Kanyama compound finding a reliable financial solution can feel like searching for a lost memory card.

Biu money loans Zambia suits both the best loans for civil servants and the best cheapest loans in Zambia and its procedures are similar to UNIFI Loans.

This is where Biu money loans Zambia comes in – a platform that’s transforming the way civil servants and salaried employees in Zambia manage financial unexpectation. I have ranked Biumoney as the number one loan service provider for Civil servants and other salaried workers for a reason.

Though Biu money loans Zambia is similar to Zamloan and Zamcash, there are few important differences which we have discussed in this same article.

As an active client of BiuMoney, we can confidently say that this service has become a lifeline for those of us who need fast, collateral-free loans without paperwork. If you’re in search of a lending partner that understands your needs, look no further than BiuMoney.

To access fast and reliable financial support, customers can start with the Biu Money Loans Zambia Login Registration process through the official Biu Money link, where the user login – Biu Money portal allows easy tracking of loan status and repayments. Once approved, clients can make their Biu Money Loans Zambia payment conveniently using mobile money options, including Biu Money payment Airtel.

For those who prefer offline applications, the platform provides a Biu Money loan application forms download download option. In case of any issues or inquiries, borrowers can easily reach out via the Biu Money contact number or the Biu Money contact number Zambia, ensuring they get timely assistance throughout the borrowing process.

The Biu money loans Zambia Difference

What makes BiuMoney Salary Advance and Loans stand out is their focus on simplicity and speed advance salary processing. With just one click and a few easy steps, you can have your Salary Advance and or Loan disbursed into your account in under 17 minutes. No lengthy processes, no collateral, no high interests and no hidden fees – just straightforward salary advances with flexible terms which you must enjoy without pressure.

The repayment process is as manageable as the application. You have 60 – 90 days to repay, and you’ll enjoy some of the most competitive interest rates available by Biumoney. Better still, Biu money loans Zambia welcomes partial payments, so if you can only pay back a portion of the loan early, they won’t penalise you. In fact, doing so may increase your creditworthiness for future loans. Make sure that you have an honest credit record.

Professional Views about Biumoney loans

If there is something so frustrating is having a long process for money acquisition when you need it most. Most salaried workers and civil servants seek a loan or salary advance only when there are immediate expenses to cover. Biumoney is your immediate sure solution.

Therefore, it is appropriate that during this period the requested money is disbursed within the required period of time.

Why Biu money loans Zambia is the Best for Civil Servants and Salaried Workers

Civil servants and salaried employees have unique financial needs, and Biu Money understands that. Whether it’s an emergency(from your village uncles), covering unexpected costs, or bridging the gap between paychecks, Biu Money offers tailored loan solutions that cater specifically to your circumstances. Their quick approval process ensures that you won’t be left waiting when time and pressure is painfully facing you like Esther Phiri in a ‘’ring’’.

Moreover, the loan limits are designed to grow with you. As you establish a history of on-time payments, your loan limit increases. Most Zambian Banks take time to process Salary Advance and other loans (you and i are not ignorant about this) but with Biu money all is easy – that’s why i am recommending this service to you.

Biu Money Compared to other Civil – Servant loan providers

| Interest Rate in % | Disbursement Duration | Loan Availability | |

| Biumoney | 30.2 | 5 min – 17 min | Civil Servants and Business persons |

| Zamcash | 30 | 3 min – 5 min | Everyone who is aged 21 and above |

| Zamloan | 32 | 10 min – 15 min | Mainly for civil servants |

| Lupiya | 35 | 40 min – 60 min | Civil – Servants only |

| ExpressCredit | 32 | 3 hour – 48 hours | Government Workers only |

| Premier Credit Zambia | 31 | 6 hours – 72 hours | Government workers only |

| PowerKwacha | 33 | 30 min – 35 min | Government workers only |

How to Apply

Applying for a Salary Advance or traditional loan through Biu Money is easier than you think. Here’s a simple step-by-step guide I used:

But before applying, make sure that you have your national registration card (N.R.C), phone numbers of your workmate or family member, good internet connection, latest pay slip and a very active personal phone number, especially the one you use in mobile money transactions.

Additionally, never attempt to apply for Biu money loans Zambia before reading through the instructions/steps given below. After you have read prepare the necessary documents as earlier stated, for a pay slip store it in your device for upload purposes during the application process.

Once all is done we have provided a ‘safe link’ for the sake of reducing chances of your loan application being rejected.

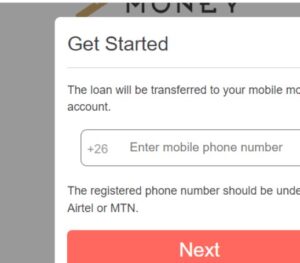

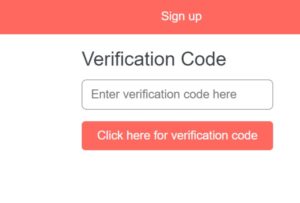

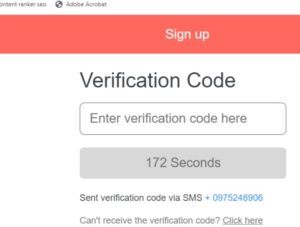

- Visit the BiuMoney website(Not Now, the link is provided below): it doesn’t have a complicated design. Enter your Mobile phone number: Register an account using your National Registration Card (NRC) and Airtel or MTN line. The OTP will be sent to the numbers you have submitted at stage 1

- Provide necessary information: Fill in your personal details, workmate or family member, making sure that all required fields are complete and accurate.

- Await approval: After submitting your information, you’ll receive a call from BiuMoney’s customer care team to verify your application and submitted details.

- Receive your money: Within minutes of approval, your loan will be deposited into your account – as simple as that.

NOTE: The images provided below serve the purpose of helping on the stages taken to apply for Biumoney loans, stage 1 is skipped because it only requires to click on the link provided in this same content. Also note that at the very final stage not shown here you may be requested to upload your latest pay slip.

WARNING: NEVER PROVIDE A FALSE INFORMATION, IT IS A FELONY!

Transparency and Fairness

One thing I truly appreciate about Biu Money is their transparency. You know exactly what you’re getting into from the start—no hidden fees, no surprise charges. The small processing fee of K25 is clearly outlined upfront, and Biu Money’s customer care is always available to clarify any doubts.

Their commitment to being ethical lenders shows in the way they treat their clients. If, for any reason, you encounter difficulties with repayment, they work with you rather than against you, offering manageable solutions to ensure that you stay on track.

Pros and Cons of Biu money loans Zambia

| PROS | CONS |

|---|---|

| – instant Cash | – No App |

| – No paper work | – Civil servants only |

| – Good Customer Service | |

| – Very Low interest rate | |

| – Partial repayments | |

| – Website user friendly | |

| – huge amounts accepted | |

| – Only K25 service fee |

Biu Money Summary

| Interest rate % | Loan Tenure | Minimum Amount | Maximum Loan Amount | Processing Time |

| 20 – 31.2 | 14 – 30 days | K200.00 | K100,000.00 | 3 min – 24 hours |

Reasons Why Biu money loans Zambia Are the Best for Civil Servants according our observation:

Salary-Based Repayment Plans

Biu money loans Zambia offer repayment plans meant for civil servants’ monthly salaries, ensuring repayments are automatically deducted in manageable amounts monthly without raising complaints.

Lower Interest Rates

Civil servants enjoy preferential, lower interest rates due to their job security, making loans more affordable in the long term – less than 30%.

Quick Loan Approval (the foundation of Biumoney loans)

The loan approval process is fast for civil servants since their steady income stream lowers the risk for lenders, ensuring timely access to funds – within a few hours regardless of one’s location and money requested.

Flexible Loan Amounts

Biumoney allows civil servants to borrow based on their specific needs, whether it’s for emergency expenses, home improvement, or personal projects.

Minimal Documentation (Biu money loans Zambia’ good reputation)

As trusted government employees, civil servants often require less paperwork, speeding up the loan application and approval process. We don’t like excessive paper submission do we? With Biu money loans Zambia only online latest pay slip submission is required.

Reliable Financial Stability

With a stable income, civil servants can secure higher loan amounts, which increases their access to funds for larger projects or investments yearly.

Special Loan Programs

Biu money loans Zambia offer exclusive loan programs for civil servants, including debt consolidation, home improvement, and salary advance loans, which are not always available to other borrowers as I have reviewed earlier.

Job Security Advantage of Biu money loans Zambia

Civil servants’ secure employment status reduces the risk of default, making them more eligible for favourable loan terms and extended repayment periods.

These features make Biu money loans Zambia a reliable and effective solution for civil servants seeking financial support.

How to repay Biu money loans Zambia?

Mainly there are two (2) ways for Biu money repayments; both ways require the use of mobile money wallets – Airtel or MTN

Method 1 (Using Airtel Money)

1.Dial *115#

2.Choose option 4 (Make Payment)

3.Enter option 6 (Goods & Services)

4.Enter number 1 on ‘’merchant code’’

5.business name type “biu” without spaces

6.Enter repayment amount e.g 2000

7.Enter your N.R.C number as your reference without slashes.

8.Enter your personal mobile money wallet pin

9.Airtel charges a k3.5 for this transaction so deposit it in your account.

NOTE: You can make payment with another mobile money account that is not in your name as long as you indicate your NRC on reference so that the Biumoney system detects that you have paid. In case you have entered a wrong reference (N.RC) contact the Biu money loans Zambia as soon as possible.

Method 2 (Using MTN Money)

1.Dial *115#

2.Enter pay bill on option 3

3.choose retail payment on option 8

4.Enter Merchant code enter biu without spaces

5.Enter Repayment loan Amount e.g 3700

6.Enter your N.R.C as a Reference.

7.Enter your mobile money PIN to confirm the payment.

Frequently Asked Questions (FAQs) about Biu money loans Zambia for Civil Servants and Salaried Workers in Zambia

How do I contact BiuMoney?

You can contact BiuMoney through the following numbers:

+260767497768 / +260770438151.

What is the difference between Zamcash and BiuMoney?

Zamcash provides loans to a wide range of individuals, including students, business owners, and salaried workers. In contrast, Biu money loans Zambia focuses primarily on civil servants and other permanent salaried workers in Zambia, just like Zamloan.

What is Biu money loans Zambia?

Biu money loans Zambia is a financial platform that provides instant loans, particularly designed for civil servants and other salaried workers in Zambia. They offer fast, collateral-free loans with simple and transparent terms.

Who can apply for Biu money loans Zambia?

BiuMoney loans are available to civil servants, salaried employees, students, and business owners in Zambia who need quick access to financial assistance.

How fast can I receive a loan from BiuMoney?

BiuMoney is known for its speed. Once your loan application is approved, you can expect to receive the funds in your account in less than 17 minutes.

Do I need collateral to apply for a Biu money loans Zambia?

No, BiuMoney loans are unsecured loans. The platform provides unsecured loans that can be accessed quickly and easily – just online.

What is the interest rate on BiuMoney loans?

BiuMoney offers competitive interest rates, typically lower than 30%, making it one of the more affordable loan options for civil servants and salaried workers in Zambia.

Can I make partial repayments?

Yes, BiuMoney allows partial repayments. This helps improve your creditworthiness and does not incur penalties, giving you flexibility in managing your loan.

What is the maximum loan amount I can borrow?

The loan amount you can borrow depends on your salary and repayment history with BiuMoney. As you build a history of on-time payments, your loan limit may increase.

How can I apply for a BiuMoney loan?

Applying for a BiuMoney loan is straightforward. You simply need to visit their website, sign up using your National Registration Card (NRC), fill in your details, and wait for a call from BiuMoney’s customer care to verify your application. Once approved, the money will be disbursed to your account.

Are there any hidden fees when applying for a BiuMoney loan?

No, BiuMoney operates with full transparency. There are no hidden fees or charges. The processing fee is clearly stated upfront, which is K25.

What happens if I encounter difficulties repaying my loan?

If you face difficulties repaying your loan, BiuMoney’s customer care team is willing to work with you to find a manageable solution. They offer flexible terms and do not penalise you for financial hardships.

Is BiuMoney the best option for civil servants and salaried workers?

Yes, BiuMoney is one of the best financial solutions for civil servants and salaried workers in Zambia due to their tailored loan plans, fast approval, lower interest rates, and salary-based repayment options.

Are there any special loan programs for civil servants?

BiuMoney offers special loan programs for civil servants, including debt consolidation, home improvement loans, and salary advances.

What makes BiuMoney different from traditional bank loans?

BiuMoney stands out due to its quick loan processing, absence of collateral, minimal paperwork, and tailored loan products for civil servants and salaried workers. Traditional bank loans often take longer and involve more documentation.

Does BiuMoney provide loans to people outside Lusaka?

Yes, BiuMoney provides loans to civil servants and salaried employees all across Zambia, regardless of their location. Approval and disbursement are processed quickly no matter where you are.

Conclusion

Whether you’re a civil servant trying to make ends meet or a salaried worker facing an unexpected expense, I have confirmed that BiuMoney Loans offer a hassle-free, transparent, and fast solution to your financial needs. Their loan process, combined with their excellent customer service, makes them a top choice for anyone seeking quick access to funds without the headache of collateral.