In today’s world, getting a loan can help you achieve your financial goals—whether it’s starting a business, paying school fees, settling an emergency, or consolidating debt. But with many types of loans out there, one question stands out: What loan can I get?

The answer depends on several factors like your income, credit score, employment status, and the lender’s criteria. In this blog post, we’ll break down your options so you can find the loan that suits your situation best—even if you have bad credit.

Before we dive in we would like to let you know that there are 9 things to know before getting the loan. We have a lists of the best cheapest loans, easy loans to get online, best loans without collateral and best loans for civil servants.

Our Best Picks Suiting All Your Needs

What Loan Do I Qualify For in Zambia?

The type of loan you qualify for depends on your financial background. Here are common types of loans and who qualifies for them:

1. Personal Loans

- Best For: General expenses like medical bills, home repairs, school fees.

- Requirements: Proof of income, ID, and sometimes a good credit score.

- Popular Providers in Zambia: Zamcash, Zamloan, BiuMoney and Lupiya.

2. Salary-Based Loans for Civil Servants

- Best For: Civil servants, government employees, or salaried workers.

- Requirements: Pay slip, employment letter, and bank statement.

- Recommended Lenders: Bayport, ExpressCredit, Doza Loans.

3. Business Loans

- Best For: Registered businesses needing capital.

- Requirements: PACRA registration, business bank account, ZRA TPIN.

- Zambian Providers: NATSAVE, FINCA, Empower Loans.

4. Collateral Loans

- Best For: Those who own cars, property, or land.

- Requirements: Title deeds or vehicle papers.

- Example Services: Izwe’s Car4Cash, ElitePay, PowerKwacha.

What Loan Can I Get with Bad Credit?

Having a low credit score doesn’t mean you’re out of options. Many lenders in Zambia offer loans even if you have a poor credit history. Hence your question What Loan Can I Get in Zambia can be difficult to answer.

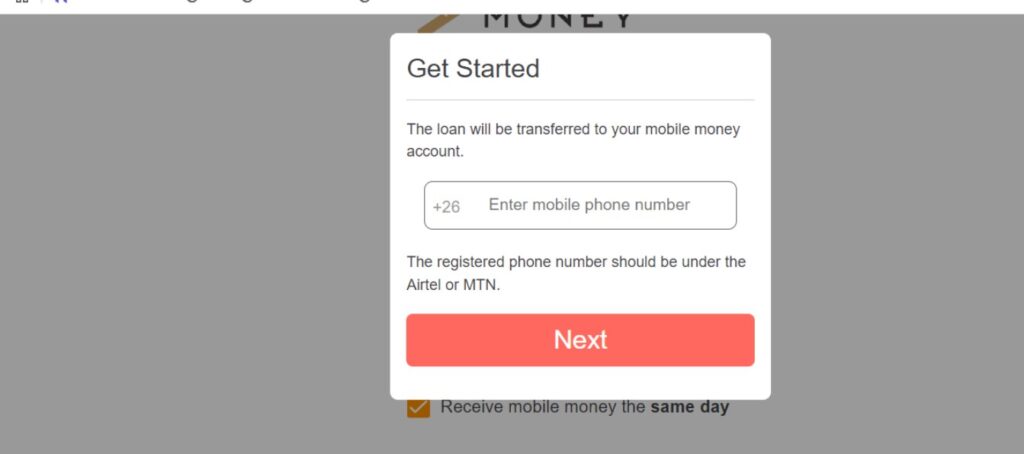

1. Mobile Money Loans

- Example Providers: Biumoney, Zamcash, Mwachunga Loans.

- Features: No collateral, minimal paperwork, quick approval via mobile.

2. Unsecured Loans

- Ideal For: People with no assets.

- Available From: Zamloan, Panda Africa, CreditCare.

3. Loan Offers with Flexible Terms

Some lenders focus more on your current income than your past mistakes. These loans may come with higher interest but still help when you’re in need. Many people have asked the same question “What Loan Can I Get in Zambia?” because they are not aware of the most flexible terms.

💡 Tip: Repaying a small loan on time can rebuild your creditworthiness for future applications.

Factors That Determine What Loan You Can Get

Before applying, consider these:

- Monthly income – Is it stable and enough to cover repayments?

- Employment type – Are you a civil servant, business owner, or casual worker?

- Credit report – You can clear your record through TransUnion Zambia if needed.

- Collateral availability – If you own valuable items, you can access bigger loans.

After applying the factors listed above then ask the question again “What Loan Can I Get in Zambia?” then your answer will be instantly be found.

How to Know the Best Loan for You

Here are a few tips to choose the right loan:

- Compare interest rates – Low interest means less to pay back.

- Understand repayment terms – Shorter durations may have higher monthly payments.

- Check eligibility – Use online tools or talk to a loan officer.

Final Thoughts: What Loan Can I Get?

Whether you’re a civil servant, student, small business owner, or someone with bad credit, there’s a loan out there for you – which could answer your question “What Loan Can I Get in Zambia?” The key is knowing your financial profile and choosing the right lender that matches your needs. Start small, borrow wisely, and build a strong financial foundation.

Frequently Asked Questions (FAQs)

1. Can I get a loan if I’m unemployed?

Yes but most lenders require a steady income. However, you may qualify for a loan if you have collateral or a guarantor.

2. How can I check if I’m blacklisted in Zambia?

Visit the TransUnion Zambia portal or ask a loan provider to check your CRB status. See our review on CRB here

3. Are there government loan programs available?

Yes, through CDF loans and Citizens Economic Empowerment programs for youth and women. The same government bodies and programs can find the solution to the problem of “What Loan Can I Get in Zambia?”

4. What is the fastest loan I can get online in Zambia?

Zamcash is the fastest online loan of all time in Zambia followed by Zamloan then Biumoney -they offer instant approval within minutes.