Should you get a loan? Loans of any kind have become more common than before. Thus, for many the subject of loans has attracted many concerns.

In this guide we have discussed 9 vital things or factors to consider before getting a loan of any kind. First of all it is good to note that our stance is not based on distancing people from the loan and credit accessibility, rather to guide them on how best they can do it.

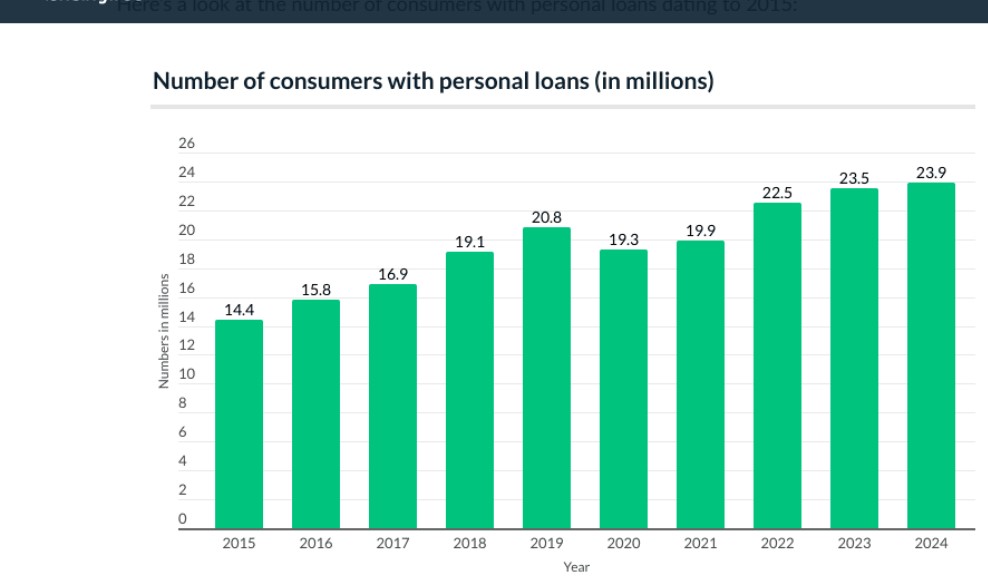

We do promote loans with low interest rates for both Zambian Government workers and non Government workers because the wealth of today is built on borrowed money according Robert Kiyosaki an American Entrepreneur mostly known for his book – Rich dad poor dad. According to personal loan statistics in American close to 24 million Americans have personal loans. In our discussion, we have combined dos and don’ts in the same paragraphs.

Source: TransUnion. Second Quarter of 2024

1. Never get a loan for luxury

For us this is the first point to take note of. We have seen a good number of people getting a loan for the sake of being ‘recognised’ as rich people in their society, this is wrong, get your loan to work for your wealth building and not to look rich. Luxury activities include:

- Wedding initiations

- Buying cars not planed for business

- Buying expensive mobile gadgets.

- Visiting beautiful places for vacations.

- Attending expensive events such as Album launches, comedy events

- Not well planned Academic Paper Upgrades.

2. Starting a new business.

This may raise some questions but it is just as true as it is – don’t start a new business using a loan instead invest your loan in an already established one which is well arranged and you have more experience in it.

Never allow some external uninvestigated investments such as high interest rate savings, we have seen people being scammed over unreal businesses.

If you don’t have any established business of yours, start one without any loan, do it for at least four years, gain experience, know its weaknesses and strengths. If it pleases you and it is generating profits then get a loan and invest in it.

3. Avoid entrusting a borrowed money to someone else hand

The thirst for quick money gain is increasing high in people’s minds today, entrusting someone else with money increases the risk of making huge losses. Some may ask, what about my parents, close best friends, spouse, siblings? Well, I have no direct answer to your question. All that I know is that the majority of people have lost their hard earned money due to the same group you have mentioned. If you are not capable of being a steward of your own wealth stay the way you are never get a loan!

4. Never announce your plans of getting a loan

As discussed earlier whenever we pose a question ”should you get a loan” we are not doing it for the purpose of showing off but for income generation and wealthy creation. Once it is known by your family and close friends that a good amount of money is in your hand, you will automatically become a source of help. Don’t think that you will avoid everybody. In this case the question of ‘should you get a loan?’ – for you the answer is NO.

5. Should you get a loan? Have a great resistance in giving out money

Let me expose this to the readers. According to my experience, families are number one enemies of progress in Africa, (okay maybe you are safe). Avoid unnecessary responsibilities. You see, what happens at the end of the day if you don’t succeed after many years of working is that none will look at how many people you have brought up, educated or fed but all what they will say is that you are not a good manager of your resources. Hence, when we ask you that ‘should you get a loan’ just remember your level of your generosity and answer the question.

Additionally, none will come and help you in your old age and misfortunes. Excessive help does not prove you to be more spiritual.

6. Choose the right Loan lending body.

Have patience and choose the money lending institution after knowing its terms and conditions, and interest rate. Do not follow friendly recommendations anyhow and research thoroughly at your own time. That’s one of our works here, we do recommend loans of low interest rates.

7. Plan for it (Write a Business Plan)

Do not invest your loan randomly, rather invest it in the already established business which you own. Take your time to come up with a clear business plan.

8. Do not use a loan to solve your personal or family problems.

This one of the common errors of loan borrowers, using your loan to solve personal problems is like racing in a circle. This is because after depleting your loan like Airtel Bundle you will have no option but to go and get another loan.

Solve your problems using other sources.

Treat your loan purely as money for business and not for relationships (just for men) and problem solving.

9. Avoid applying for ‘’small’ amounts of loan.

We do recommend getting a loan of at least $1900 (For Zambians), when the amount is small, the budget is small, the income is small and the reasoning abilities become small.

Frequently Asked Questions about ‘should you get a loan?’

a. Should you get a loan for luxury purchases?

No, it’s highly discouraged to take out a loan for luxury expenses like vacations, expensive gadgets, or non-business-related cars. Loans should be used to grow your wealth, not to project an image of wealth.

b. Is it a good idea to start a new business with a loan?

Starting a new business with a loan can be too risky. It’s better first to establish a business with personal funds, gain experience, and then use a loan to scale or expand the business once it’s profitable.

c. How can I choose the right loan provider?

Always research different lending institutions, compare their interest rates, terms, and conditions. Do not rely solely on recommendations from friends or family—make sure the lender fits your financial situation and goals.

d. Why is it important to avoid sharing my loan plans with others?

Sharing your loan plans may lead to unnecessary financial pressure from friends or family members who may seek assistance from you. Keeping your financial decisions private can help you stay focused on your business or investment goals.

e. What should I do if I need a loan to solve personal or family problems?

Using a loan to solve personal or family issues is not advisable. This can lead to a cycle of debt. Instead, try to address these problems with other financial solutions and reserve loans for income-generating purposes.

f. What’s the minimum loan amount I should apply for?

Applying for small loans can limit your financial growth. We recommend applying for a loan of at least $1,900 to ensure you have enough capital for meaningful investments or to meet substantial business needs.

Conclusion:

When considering the question, “Should you get a loan?”, it’s essential to approach the decision with careful planning and a strategic mindset. This guide highlights the key dos and don’ts to help you navigate loan decisions wisely. Avoid borrowing for luxury or personal expenses and focus on using loans to grow established businesses or meaningful investments. Choose reputable lenders with favourable terms, create a solid business plan, and protect your loan from unnecessary financial drains. By adhering to these principles, you can leverage loans to build wealth and ensure long-term financial stability.